Key Debates On China Online Education Group Stock: A Deep Dive

When it comes to China Online Education Group stock, there's a lot of buzz going around. Investors are curious, analysts are divided, and the market is swinging like a pendulum. So, what's all the fuss about? Let’s break it down for you in a way that’s easy to digest but still packed with insights.

You’ve probably heard whispers about this company in the investing world. Maybe you’ve seen some headlines or scrolled past tweets mentioning their stock. The truth is, China Online Education Group has been at the center of some heated debates lately. And trust me, these debates aren’t just about numbers—they’re about the future of education, tech, and global markets.

This article isn’t just another regurgitation of facts. We’re diving deep into the key debates surrounding China Online Education Group stock, exploring both sides of the coin, and giving you the tools to make informed decisions. Whether you're a seasoned investor or just starting out, this is your go-to guide for understanding the hype.

Understanding the Basics of China Online Education Group

Before we dive headfirst into the debates, let’s get our bearings straight. China Online Education Group, often referred to as COED, is a leading player in the online education space. Their mission? To revolutionize education by leveraging technology to deliver quality learning experiences. But what makes them stand out in a crowded market?

Here’s a quick rundown:

- They’ve been expanding rapidly, tapping into both urban and rural markets.

- Their platform offers everything from K-12 education to professional development courses.

- Their innovative approach to edtech has caught the attention of investors worldwide.

But like any rising star, they’ve also faced their fair share of challenges. Regulatory hurdles, market volatility, and intense competition are just a few of the hurdles they’ve had to jump over.

- Eva Longoria Elizabeth Judina Longoria A Journey Beyond The Spotlight

- King Von Autopsy Report Unveiling The Truth Behind The Tragic Loss

Why Is Everyone Talking About COED Stock?

It’s simple—COED stock has become a lightning rod for discussions about the future of education and investment. Here’s why:

- **Growth Potential:** With the global shift toward digital learning, COED is positioned to capitalize on a booming market.

- **Policy Changes:** Recent regulatory changes in China have sent shockwaves through the industry, affecting stock performance.

- **Market Sentiment:** Investors are torn between optimism about long-term gains and caution due to short-term uncertainties.

In short, COED isn’t just a stock—it’s a symbol of the broader changes happening in the education sector. And that’s what makes it so fascinating.

Key Debate #1: The Impact of Regulatory Changes

One of the biggest debates surrounding COED stock revolves around regulatory changes in China. In recent years, the Chinese government has cracked down on the education sector, imposing stricter rules on for-profit educational institutions. For some, this spells disaster. For others, it’s an opportunity to reassess and adapt.

Here’s how it breaks down:

- **Pro-Regulation Stance:** Supporters argue that these regulations will lead to a more ethical and sustainable industry. By curbing excessive commercialization, the focus can shift back to quality education.

- **Anti-Regulation Stance:** Critics, however, fear that these regulations could stifle innovation and hinder growth. They point to the immediate drop in stock prices as evidence of investor concern.

So, who’s right? That’s the million-dollar question. What we do know is that regulatory changes are here to stay, and companies like COED will need to navigate them carefully.

How Are Investors Reacting?

Investor sentiment is a mixed bag. Some are holding onto their shares, betting on long-term recovery. Others are cutting their losses and moving on. The key takeaway? Stay informed and keep an eye on policy developments.

Key Debate #2: The Role of Technology in Education

Another hot topic in the COED stock debate is the role of technology in education. As a tech-driven company, COED relies heavily on digital tools to deliver its services. But is this reliance a strength or a weakness?

Let’s explore both sides:

- **Tech Enthusiasts:** They believe that technology is the future of education. With advancements in AI, VR, and personalized learning, COED is well-positioned to lead the charge.

- **Tech Skeptics:** On the flip side, skeptics worry about over-reliance on tech. They argue that digital solutions can’t fully replace traditional teaching methods and may leave some students behind.

The reality likely lies somewhere in the middle. While technology offers incredible opportunities, it also comes with challenges that need to be addressed.

What Does This Mean for COED Stock?

For investors, the key is understanding how COED plans to balance innovation with inclusivity. Are they investing in R&D to stay ahead of the curve? Are they addressing concerns about accessibility and equity? These are the questions that will shape the future of their stock.

Key Debate #3: Market Volatility and Investor Confidence

Market volatility has been a recurring theme in the COED stock narrative. As with any emerging market player, fluctuations are to be expected. But what’s driving this volatility, and how should investors respond?

Here’s a breakdown:

- **Economic Factors:** Global economic conditions, such as inflation and interest rates, play a significant role in stock performance.

- **Political Factors:** Geopolitical tensions, especially between China and other countries, can impact investor confidence.

- **Company-Specific Factors:** Internal developments, like partnerships or product launches, can also influence stock prices.

Investors are encouraged to adopt a long-term perspective. While short-term fluctuations can be nerve-wracking, they often even out over time.

Strategies for Navigating Volatility

So, how can you protect your investments in a volatile market? Here are a few tips:

- Diversify your portfolio to spread risk.

- Stay informed about market trends and company news.

- Consult with financial advisors for personalized advice.

Remember, every dip is an opportunity in disguise. It’s all about timing and strategy.

Key Debate #4: The Competition Factor

COED isn’t the only player in the online education game. With fierce competition from both domestic and international companies, how does COED stack up?

Here’s a snapshot:

- **Strengths:** COED boasts a strong brand presence, a wide range of courses, and a deep understanding of the Chinese market.

- **Weaknesses:** They face challenges in terms of pricing, scalability, and maintaining quality across their platform.

While competition is stiff, COED has shown resilience and adaptability. Whether they can maintain their edge remains to be seen.

What Sets COED Apart?

COED’s unique selling points include their focus on personalized learning, their commitment to innovation, and their strategic partnerships. These factors could give them an edge in the long run.

Key Debate #5: The Future of Online Education

Looking ahead, the future of online education is bright—but not without its challenges. As more students and educators embrace digital tools, the demand for quality online education will only grow. But what does this mean for COED?

Here’s what experts are saying:

- **Opportunities:** Expansion into new markets, development of cutting-edge technologies, and collaboration with global partners.

- **Challenges:** Ensuring compliance with regulations, maintaining profitability, and addressing concerns about data privacy.

The path forward won’t be easy, but COED has the potential to shape the future of education in meaningful ways.

How Can Investors Prepare?

Investors should focus on understanding the broader trends in education and technology. By staying informed and adapting to change, they can position themselves for success.

Conclusion: Making Sense of the Debates

In conclusion, the debates surrounding China Online Education Group stock are complex and multifaceted. From regulatory changes to technological advancements, there’s a lot to consider. But one thing is clear—COED is a company with immense potential.

As an investor, it’s important to weigh the pros and cons carefully. Keep an eye on market trends, stay informed about regulatory developments, and don’t hesitate to seek professional advice when needed.

And remember, the best investments are those that align with your values and goals. Whether you’re bullish on COED or taking a wait-and-see approach, the key is to stay engaged and informed.

So, what’s your take? Share your thoughts in the comments below, and don’t forget to check out our other articles for more insights into the world of investing. Let’s keep the conversation going!

- Sarah Jessica Parkers Weight And Height The Inside Story Youve Been Waiting For

- Maecee Lathers Net Worth The Rising Stars Journey To Success

About Us Quality Online Education Group

Online Education. Online Education of Group of Friends Students at

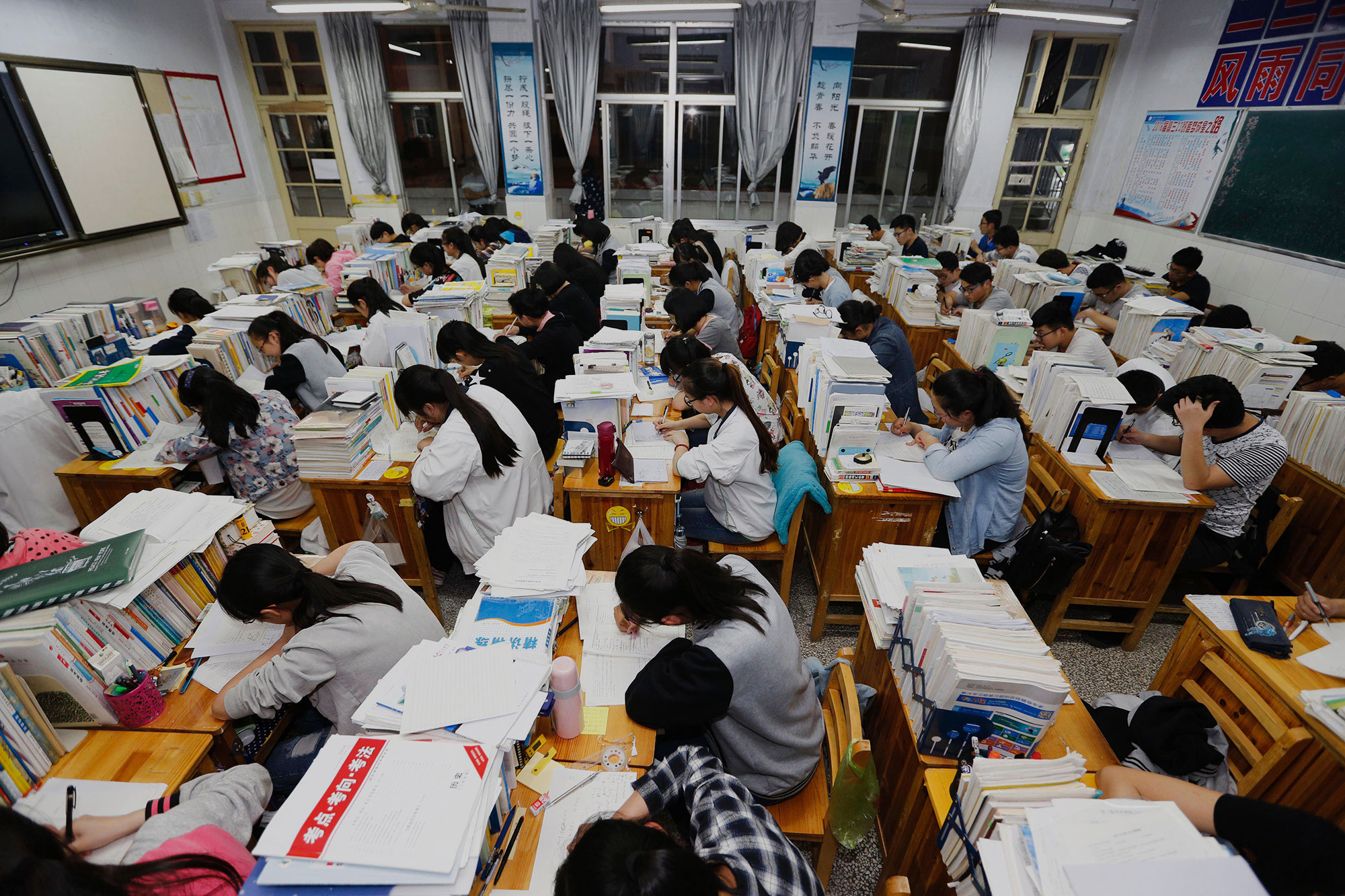

How does education in China compare with other countries? ChinaPower