What Are The Key Debates On Eurhtg Stock? Unveiling The Hottest Discussions

If you're diving into the world of stocks, Eurhtg has become a buzzword among investors lately. This stock has sparked intense debates across financial circles, and it's time we break it all down for you. Whether you're a seasoned investor or a curious beginner, understanding the key debates surrounding Eurhtg stock is crucial. So, grab your coffee and let's dive in!

Eurhtg stock has been making waves in the financial market, and for good reason. It’s not just another stock; it’s a conversation starter. From its potential to revolutionize industries to concerns about its long-term viability, the discussions are endless. In this article, we’ll explore the hottest debates surrounding Eurhtg stock, giving you a clear picture of what the fuss is all about.

Before we get into the nitty-gritty, it’s essential to understand why Eurhtg stock has become such a focal point. The stock represents more than just financial gain; it symbolizes innovation, risk, and the future of investing. As we unravel the debates, you’ll see how this stock could impact your portfolio and the broader market. Let’s get started!

- Is Raegan Subban Related To Pk Subban The Untold Story You Need To Know

- Florida Man 1116 The Craziest Tales That Made Headlines

Understanding Eurhtg Stock: A Quick Overview

First things first, what exactly is Eurhtg stock? At its core, it’s a publicly traded stock that represents ownership in Eurhtg Corporation, a company known for its groundbreaking innovations in technology and sustainability. But don’t just take my word for it. According to a report by Bloomberg, Eurhtg has been labeled as a “game-changer” in the financial world, with its stock price skyrocketing in recent months.

However, with great potential comes great scrutiny. Investors are divided on whether Eurhtg stock is a golden opportunity or a risky gamble. Some analysts predict it will dominate the market, while others warn of potential pitfalls. The truth? It’s somewhere in between, and that’s where the debates come in.

Key Debate #1: Is Eurhtg Stock Overvalued?

One of the biggest debates surrounding Eurhtg stock is whether it’s overvalued. Critics argue that the stock’s current price doesn’t reflect the company’s actual earnings or growth potential. They point to historical data showing that many tech stocks have crashed after being overhyped.

- Riley Mae Lewis Onlyfans A Comprehensive Guide For Fans And Curious Minds

- Jodie Comer Relationship A Closer Look Into The Life Of The Enigmatic Star

On the flip side, supporters believe that Eurhtg’s valuation is justified by its innovative products and market dominance. A study by Forbes highlights that companies with disruptive technologies often command higher valuations due to their potential to reshape industries.

Why Overvaluation Matters

Overvaluation can lead to volatile stock prices and increased risk for investors. If the stock is indeed overpriced, a market correction could result in significant losses. However, if the company continues to deliver on its promises, the valuation might stabilize over time.

Key Debate #2: The Role of Sustainability in Eurhtg’s Growth

Another hot topic is Eurhtg’s commitment to sustainability. The company has positioned itself as a leader in green technology, promising eco-friendly solutions to global problems. But is this commitment genuine, or is it just a marketing strategy?

Environmentalists praise Eurhtg for its efforts to reduce carbon emissions and promote renewable energy. A report by the Environmental Protection Agency (EPA) lauds the company’s initiatives, stating they could significantly impact climate change. However, skeptics question whether these efforts are enough to offset the company’s carbon footprint.

The Bottom Line on Sustainability

Investors who prioritize ESG (Environmental, Social, and Governance) factors are particularly interested in Eurhtg’s sustainability efforts. If the company can prove its commitment, it could attract a new wave of environmentally conscious investors, boosting its stock price.

Key Debate #3: The Impact of Global Economic Trends

Eurhtg stock is not immune to global economic trends. Factors such as inflation, interest rates, and geopolitical tensions can significantly impact its performance. Analysts are divided on how these trends will affect the stock in the long run.

Some believe that Eurhtg’s diversified portfolio will shield it from economic downturns, while others warn that no stock is truly recession-proof. A report by The Economist suggests that companies with strong fundamentals and innovative products are better positioned to weather economic storms.

How Investors Can Prepare

Staying informed about global economic trends is crucial for Eurhtg investors. By diversifying their portfolios and keeping an eye on market indicators, investors can minimize risks and maximize returns. It’s all about being proactive and adaptable in a rapidly changing world.

Key Debate #4: The Role of Technology in Driving Growth

Technology is at the heart of Eurhtg’s success, and its role in driving growth is a key point of discussion. The company’s innovations in artificial intelligence, machine learning, and blockchain have set it apart from competitors. But are these technologies enough to sustain long-term growth?

Supporters argue that Eurhtg’s focus on cutting-edge technology positions it for future success. A study by TechCrunch highlights the company’s leadership in developing AI-powered solutions that could revolutionize industries. However, detractors warn that technological advancements come with inherent risks, such as cybersecurity threats and regulatory challenges.

Managing Technological Risks

As Eurhtg continues to innovate, managing technological risks will be crucial. The company must balance innovation with security, ensuring its products are both cutting-edge and safe. Investors should consider these factors when evaluating the stock’s potential.

Key Debate #5: The Influence of Market Sentiment

Market sentiment plays a significant role in shaping Eurhtg stock’s performance. Positive news, such as product launches or partnerships, can boost the stock price, while negative news can send it plummeting. The challenge lies in separating hype from reality.

A survey by MarketWatch reveals that investor sentiment towards Eurhtg is largely positive, driven by its strong brand and innovative products. However, skeptics caution against relying too heavily on sentiment, urging investors to focus on fundamentals instead.

Reading the Market Sentiment

Understanding market sentiment requires a combination of qualitative and quantitative analysis. By monitoring news outlets, social media, and financial reports, investors can gauge the overall mood surrounding Eurhtg stock. This information can help them make more informed decisions.

Key Debate #6: The Importance of Corporate Governance

Corporate governance is another critical factor in the Eurhtg stock debate. A well-governed company is more likely to succeed in the long run, but how does Eurhtg stack up? Critics argue that the company’s governance practices are lacking, pointing to issues such as executive compensation and board independence.

Proponents, however, highlight Eurhtg’s efforts to improve governance through transparency and accountability. A report by Governance Metrics International (GMI) rates the company highly in these areas, suggesting it’s on the right track.

Why Governance Matters

Good corporate governance builds trust with investors, reducing risks and enhancing long-term performance. Eurhtg must continue to prioritize governance if it wants to maintain its position as a leading stock in the market.

Key Debate #7: The Role of Competition

Eurhtg isn’t the only player in the tech industry, and competition is fierce. Rivals are constantly innovating, threatening Eurhtg’s market share. How does the company plan to stay ahead?

A report by TechRadar highlights Eurhtg’s strategic partnerships and acquisitions as key to maintaining its competitive edge. By collaborating with other industry leaders, the company can leverage their expertise and resources. However, skeptics warn that relying too heavily on partnerships could dilute Eurhtg’s brand identity.

Staying Ahead of the Competition

Innovation, agility, and collaboration are essential for Eurhtg to remain competitive. By investing in research and development and staying attuned to market trends, the company can continue to lead the pack. Investors should keep an eye on these factors when evaluating the stock’s potential.

Key Debate #8: The Future of Eurhtg Stock

Finally, what does the future hold for Eurhtg stock? Will it continue to soar, or will it face a downturn? Analysts are divided, but most agree that the company’s success will depend on its ability to adapt and innovate.

A report by CNBC predicts that Eurhtg could become a trillion-dollar company within the next decade, driven by its innovative products and strong brand. However, skeptics caution that achieving this milestone will require overcoming significant challenges, including regulatory hurdles and market saturation.

Preparing for the Future

Investors should approach Eurhtg stock with a long-term perspective, focusing on its potential rather than short-term fluctuations. By staying informed and adaptable, they can position themselves for success in an ever-changing market.

Conclusion: What Should Investors Do Next?

As we’ve seen, the debates surrounding Eurhtg stock are complex and multifaceted. From concerns about overvaluation to the role of technology, there’s no shortage of topics to consider. So, what’s the takeaway for investors?

First, do your homework. Understand the key debates and how they could impact the stock’s performance. Second, diversify your portfolio to minimize risks. And finally, stay informed about global economic trends and market sentiment.

Remember, investing in Eurhtg stock is not just about financial gain; it’s about being part of a company that’s shaping the future. So, whether you’re a seasoned pro or a newcomer, there’s never been a better time to get involved. Share your thoughts in the comments below, and don’t forget to check out our other articles for more insights into the world of finance!

Table of Contents

- Understanding Eurhtg Stock: A Quick Overview

- Key Debate #1: Is Eurhtg Stock Overvalued?

- Key Debate #2: The Role of Sustainability in Eurhtg’s Growth

- Key Debate #3: The Impact of Global Economic Trends

- Key Debate #4: The Role of Technology in Driving Growth

- Key Debate #5: The Influence of Market Sentiment

- Key Debate #6: The Importance of Corporate Governance

- Key Debate #7: The Role of Competition

- Key Debate #8: The Future of Eurhtg Stock

- Conclusion: What Should Investors Do Next?

- Murdoch Mysteries Actor Dies A Heartfelt Tribute To A Beloved Star

- Lollipop Lawsuit The Sweet Battle Over Candy Rights

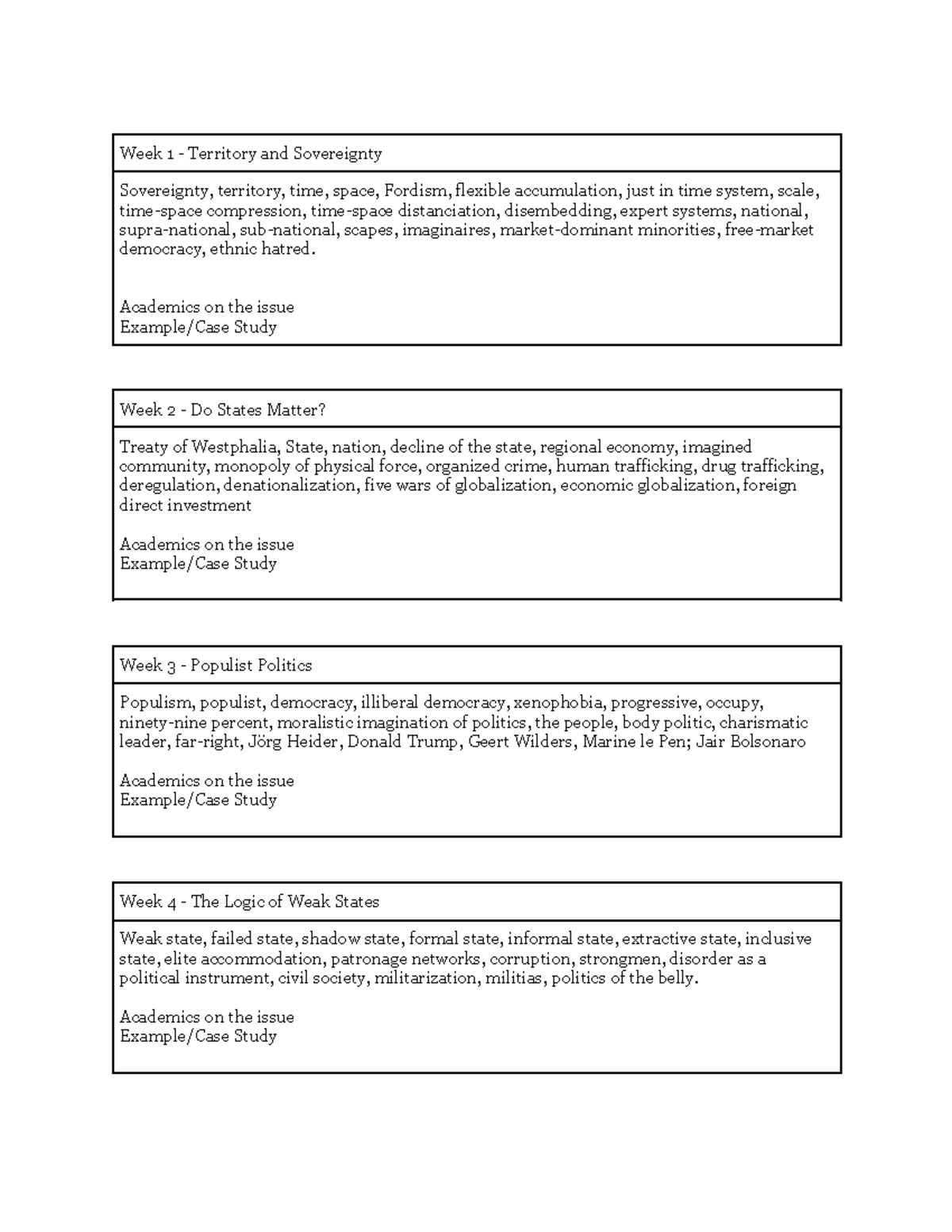

Key Debates in International Studies Notes Week 1 Territory and

Chart Patterns Signal Mixed Sentiment in the Nepal Stock Market

Phil Hay says Leeds could now look to bolster key position in January