What Are The Key Debates On Alibaba Group Holding Limited Stock? Unveiling The Controversies And Opportunities

Let’s dive right into the heart of the matter: Alibaba Group Holding Limited stock is one of the most talked-about investments in the global market today. Whether you’re a seasoned investor or someone just starting out, Alibaba has been at the center of both excitement and controversy. But what exactly are the key debates surrounding this tech giant’s stock? Let’s break it down in a way that makes sense to you.

Alibaba is not just another company; it’s a behemoth that has transformed the way we think about e-commerce and technology. However, as with any major player in the market, there are debates, discussions, and even some heated arguments about whether investing in Alibaba stock is a smart move or a risky gamble.

From geopolitical tensions to internal company dynamics, the conversation around Alibaba’s stock is as complex as it is fascinating. So, buckle up because we’re about to take you on a journey through the key debates, the potential risks, and the exciting opportunities that come with Alibaba Group Holding Limited stock.

- Jackerman 3d Model The Ultimate Guide To Unleashing Your Creative Potential

- Ramen Noodle Recall 2024 The Inside Scoop On Whatrsquos Happening

Understanding Alibaba Group Holding Limited: A Quick Overview

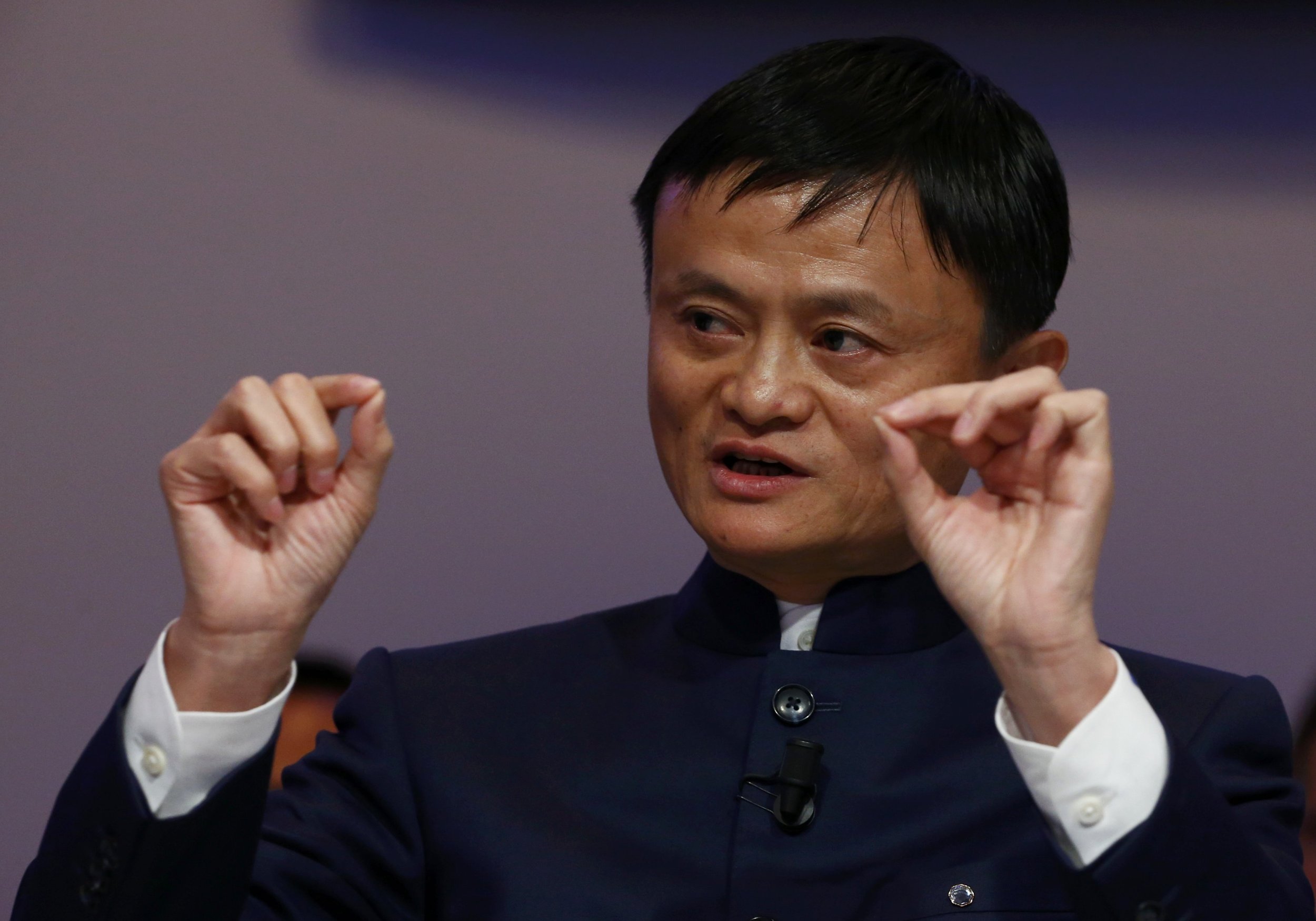

Before we dive into the debates, let’s make sure we’re on the same page about what Alibaba Group Holding Limited actually is. Founded in 1999 by Jack Ma and a group of 17 other entrepreneurs, Alibaba has grown from a small startup to a global powerhouse. The company operates in various sectors, including e-commerce, cloud computing, digital media, and more.

Alibaba’s Market Presence and Impact

Alibaba’s influence extends far beyond China. Its platforms like Taobao and Tmall have become household names, and its cloud services are among the largest in the world. But with great power comes great scrutiny, and that’s where the debates kick in. Investors are constantly analyzing Alibaba’s performance, growth potential, and risks.

Here’s a quick snapshot of Alibaba’s market presence:

- Exploring Bustyema The Ultimate Guide To Understanding And Appreciating

- The Tragedy Of Byford Dolphin A Heartbreaking Story That Still Resonates Today

- Revenue: Over $120 billion in 2022

- Market Cap: Fluctuating around $300 billion

- Global Reach: Operations in more than 200 countries

The Key Debates on Alibaba Group Holding Limited Stock

Now that we’ve got the basics covered, let’s explore the key debates that are making waves in the investment community. These debates aren’t just about numbers; they’re about the future of Alibaba and its stock.

1. Geopolitical Tensions: The US-China Trade War

One of the biggest debates surrounding Alibaba stock is the ongoing tension between the United States and China. As a Chinese company listed on the New York Stock Exchange, Alibaba finds itself in a delicate position. The trade war, regulatory changes, and political rhetoric have all impacted investor sentiment.

For instance, the delisting threat from the SEC due to auditing concerns has caused volatility in Alibaba’s stock price. Some investors see this as a temporary hiccup, while others worry about long-term implications.

2. Regulatory Challenges in China

Another hot topic is the regulatory environment in China. The Chinese government has been cracking down on tech giants, including Alibaba, to ensure compliance with new regulations. This has led to concerns about profit margins and future growth.

For example, the antitrust lawsuit against Alibaba in 2021 resulted in a record fine of $2.8 billion. While the company has since taken steps to address these issues, the regulatory landscape remains unpredictable.

3. Alibaba’s Growth Potential

On the flip side, many investors are optimistic about Alibaba’s growth potential. The company continues to expand into new markets and diversify its revenue streams. Cloud computing, in particular, is seen as a major growth driver.

Here are some reasons why investors are bullish on Alibaba:

- Strong presence in emerging markets

- Innovative business models

- Robust financial performance

Financial Performance: Is Alibaba Stock a Good Buy?

When it comes to investing, numbers don’t lie. Let’s take a closer look at Alibaba’s financial performance and how it impacts the stock debate.

Revenue Growth and Profit Margins

Alibaba’s revenue has been growing steadily over the years, although the pace has slowed down recently. In the latest quarter, the company reported a 3% year-over-year revenue growth, which is lower than previous quarters. However, analysts argue that this slowdown is partly due to macroeconomic factors rather than company-specific issues.

Profit margins, on the other hand, have been under pressure due to increased competition and regulatory costs. This has led some investors to question whether Alibaba can maintain its profitability in the long run.

Stock Price Volatility

Alibaba’s stock price has been anything but stable. Over the past year, the stock has experienced significant fluctuations, with highs of over $150 per share and lows below $70. This volatility has made some investors nervous, while others see it as an opportunity to buy at a discount.

Competitive Landscape: Who’s Alibaba Up Against?

In the world of tech and e-commerce, competition is fierce. Alibaba faces tough competition from both domestic and international players. Let’s take a look at some of its main rivals:

Tencent Holdings

Tencent is another Chinese tech giant that competes with Alibaba in areas like digital payments and cloud services. While Alibaba dominates e-commerce, Tencent has a strong foothold in gaming and social media. This rivalry adds another layer to the stock debate, as investors weigh the strengths and weaknesses of each company.

Amazon

Globally, Amazon is Alibaba’s biggest competitor. Both companies operate in the e-commerce space, but they have different business models and market strategies. While Amazon focuses on direct-to-consumer sales, Alibaba acts more as a platform for third-party sellers. This distinction affects how investors view their growth potential and risks.

Investor Sentiment: What Are Analysts Saying?

Analysts play a crucial role in shaping investor sentiment. Let’s see what they’re saying about Alibaba Group Holding Limited stock.

Bullish Outlook

Many analysts remain bullish on Alibaba, citing its strong brand, innovative products, and global reach. They believe that despite the challenges, Alibaba has the resources and expertise to overcome them. Some even predict that the stock could rebound strongly in the coming years.

Bearish Outlook

On the other hand, there are analysts who are more cautious. They point to the regulatory risks, slowing revenue growth, and increasing competition as reasons to be wary. These analysts argue that investors should proceed with caution and consider diversifying their portfolios.

Environmental, Social, and Governance (ESG) Factors

In today’s world, ESG factors are becoming increasingly important for investors. Let’s see how Alibaba stacks up in this area.

Sustainability Initiatives

Alibaba has made significant strides in sustainability. The company has committed to achieving carbon neutrality by 2030 and has invested heavily in green technologies. These efforts have been well-received by investors who prioritize environmental responsibility.

Corporate Governance

Corporate governance is another area where Alibaba has faced scrutiny. The departure of founder Jack Ma and the subsequent leadership changes have raised questions about the company’s governance structure. However, Alibaba has taken steps to improve transparency and accountability, which has helped reassure investors.

Future Prospects: What Lies Ahead for Alibaba?

As we look to the future, the question on everyone’s mind is: What’s next for Alibaba? Here are some potential scenarios:

Expansion into New Markets

Alibaba is actively exploring new markets, particularly in Southeast Asia and Europe. This expansion could open up new revenue streams and reduce reliance on the Chinese market. However, it also comes with its own set of challenges, such as navigating different regulatory environments.

Innovation in Technology

Alibaba’s commitment to innovation is another reason for optimism. The company is investing heavily in artificial intelligence, blockchain, and other cutting-edge technologies. These innovations could give Alibaba a competitive edge in the years to come.

Conclusion: Making an Informed Decision

In conclusion, the debates surrounding Alibaba Group Holding Limited stock are complex and multifaceted. From geopolitical tensions to regulatory challenges, there are plenty of factors to consider. However, Alibaba’s growth potential, financial performance, and ESG efforts make it an attractive investment opportunity for many.

So, what should you do? As with any investment, it’s important to do your own research and make an informed decision. Consider your risk tolerance, investment goals, and the current market conditions before diving in. And don’t forget to keep an eye on the latest developments in the tech and e-commerce sectors.

Finally, we’d love to hear your thoughts! Do you think Alibaba stock is a good buy? Share your opinions in the comments below and let’s keep the conversation going.

Table of Contents

- Understanding Alibaba Group Holding Limited: A Quick Overview

- The Key Debates on Alibaba Group Holding Limited Stock

- Geopolitical Tensions: The US-China Trade War

- Regulatory Challenges in China

- Alibaba’s Growth Potential

- Financial Performance: Is Alibaba Stock a Good Buy?

- Competitive Landscape: Who’s Alibaba Up Against?

- Investor Sentiment: What Are Analysts Saying?

- Environmental, Social, and Governance (ESG) Factors

- Future Prospects: What Lies Ahead for Alibaba?

- Summer Lopez Age The Ultimate Guide To Her Life Career And More

- Thomas Beaudoin Accident Injury Update The Latest On His Recovery Journey

Alibaba Group Holding Ltd Subsidiaries 2022 FirmsWorld

Alibaba Group Holding Limited (BABA) Stock Price Plunges 10 As

Alibaba Group Holding Ltd (09988) Dividends